The Financial Economic Situation Now

Published Friday, December 18, 2020 at: 7:30 PM EST

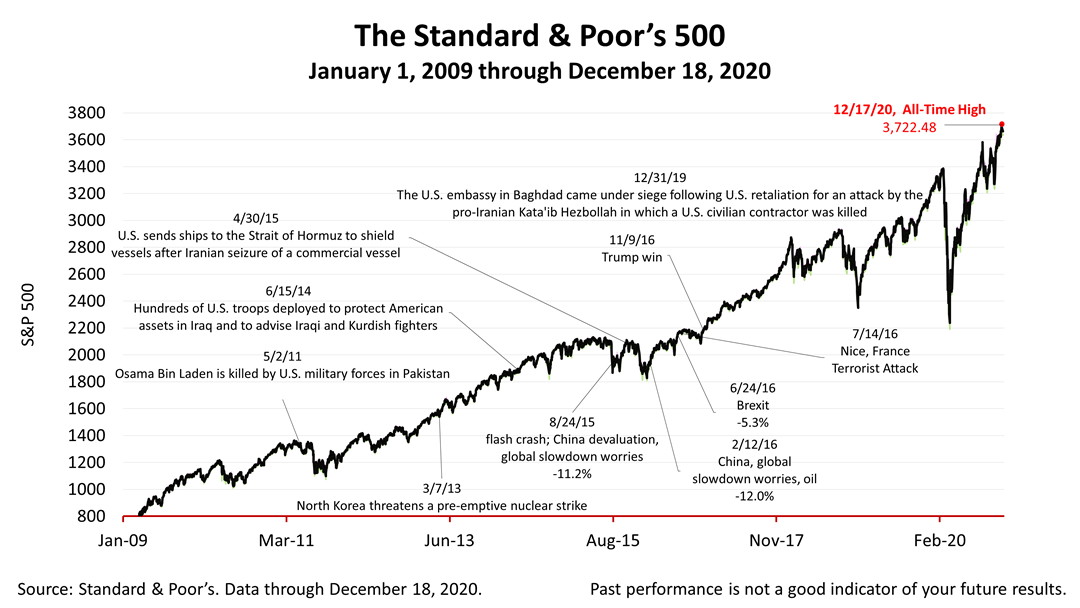

After closing at a new record high on Thursday, stock indexes declined fractionally today, as Congress struggled to meet a weekend deadline to write a law that would provide about $900 billion in additional federal relief to individuals and businesses suffering financially amid the deepening public health catastrophe.

The news has been grim. Daily death and hospitalization rates tragically broke records recently and millions of families are in financial jeopardy. At the same time, however, the broad economy is doing fine, and stocks have been breaking records due to a shift in the asset valuation paradigm, as the relative value of bonds has declined versus stocks.

The latest evidence of economic strength came in the Census Bureau’s November retail sales data release, which declined -1.1% from October. That was well below the fractional gain of one-tenth of 1% that had been expected by Wall Street. However, it was much higher than a year ago. Despite Covid, retails sales for the 12 months through November were 6.2% higher than 12 months ago.

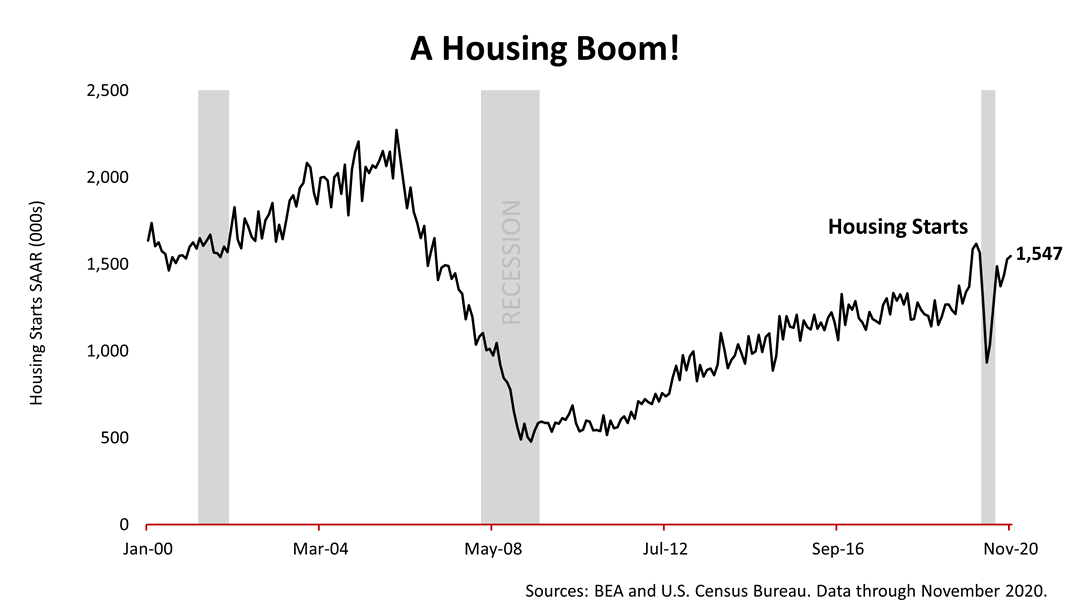

Housing starts rose yet again, to 1.547 million in November versus 1.528 million in October. It beat the 1.530 million expected by experts. Housing starts have remained well below the projected rate of 1.6 to 1.8 million that is consistent with long-term demographics and the replacement of the existing housing stock, according to estimates by academic experts in housing economics.

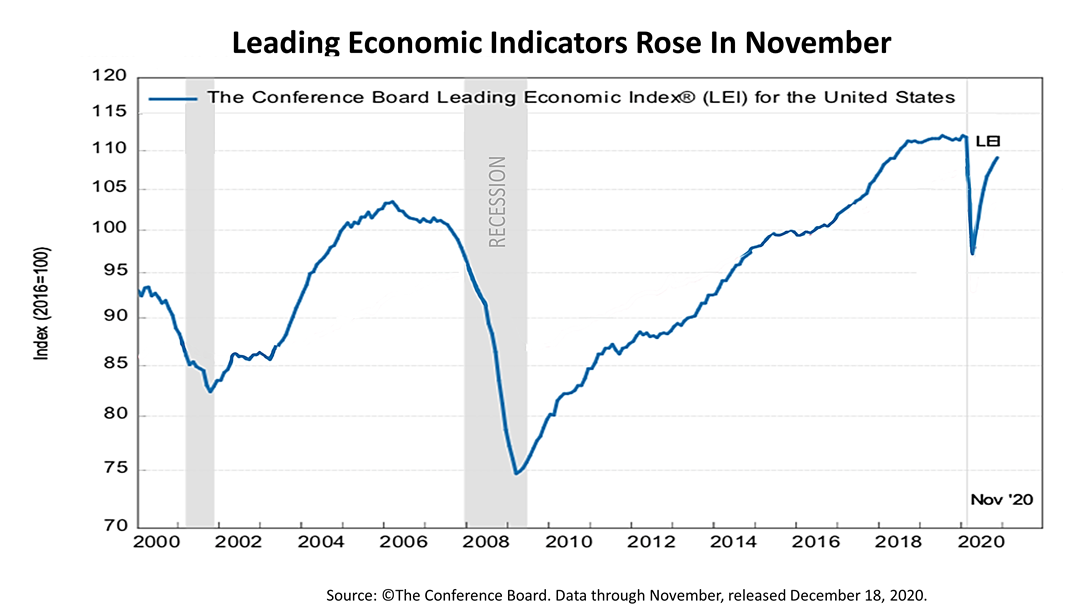

The Leading Economic Indicators, a forward-looking index of 10 key benchmarks of U.S. economic strength, rose six-tenths of 1% in November. This followed a rise of seven-tenths of 1% in both October and September. LEI growth has been decelerating since the initial Covid outbreak in the U.S. Despite the Covid crisis, the LEI is not far from its pre-pandemic high.

The Standard & Poor's 500 stock index closed Friday at 3,709.41. The index lost -0.35% from Thursday, and was +1.24% higher than last Friday’s closing price. The S&P 500 has appreciated +49.5% from the March 23rd bear market low, and closed on a new all-time high on Thursday.

Please let us know if you want an article about the changing valuation paradigm of stocks versus bonds.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding