Two Good Economic Surprises

Published Friday, October 16, 2020, 10:00 p.m. EST

With Covid infections worsening and a pivotal national election only 18 days away, it was easy to miss the two good economic surprises this past week.

From the perspective of investors trying to build wealth over the long run, here's what happened.

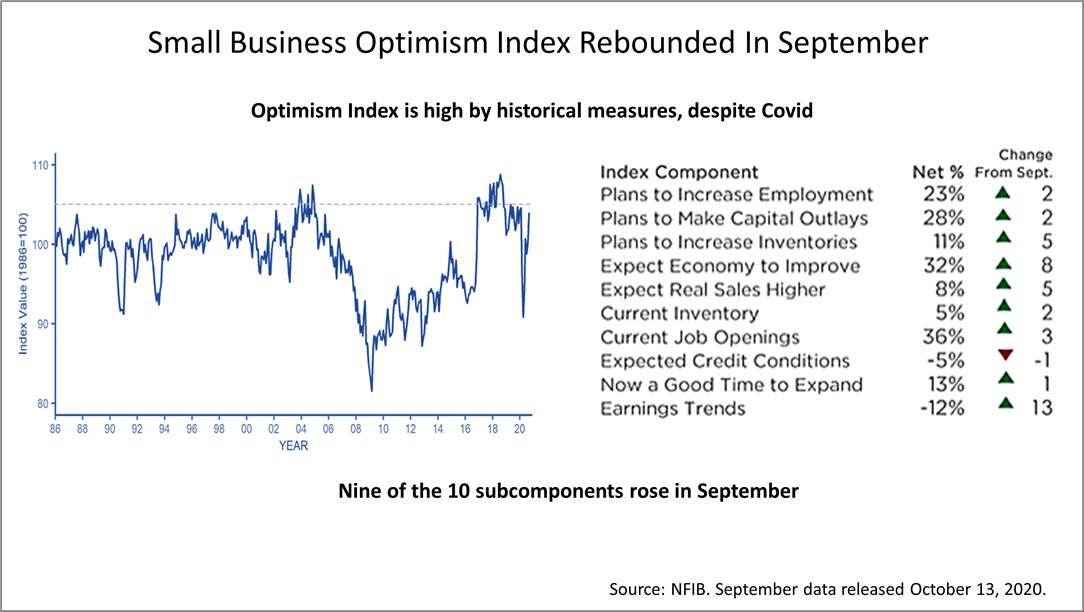

Business owner optimism increased by +3.8 points in September, according to the National Federation of Independent Business (NFIB).

Business owner sentiment is high versus its historical norm. Small businesses created 60% of all new jobs in the U.S. over the last decade, accounting for half of all employees in the U.S., which makes this a useful forward-looking indicator.

Business owners already had been optimistic in August, which makes the newly-released September surge in optimism a good surprise.

Nine of the 10 subcomponents in NFIB's index of business owner optimism, tracked by the National Federation of Independent Business, moved upward. Twenty-three percent more business owners surveyed in September by NFIB expected to increase employment. Business owners saying they planned to make capital outlays rose by +28%, and +36% more business owners in September said they had jobs openings. Owners are expecting improved business conditions over the next six months increased by 8 points.

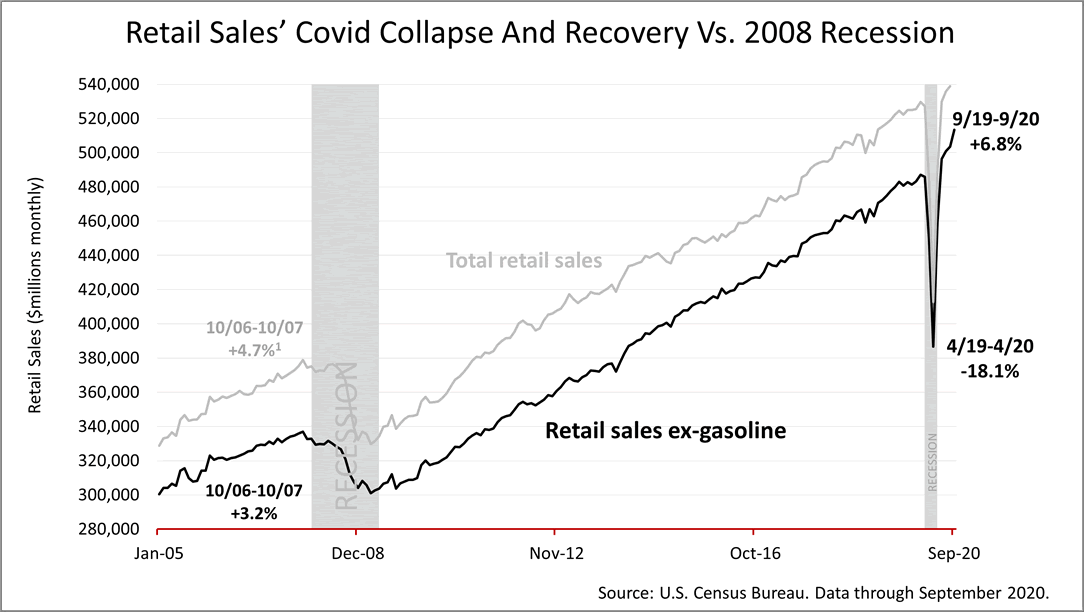

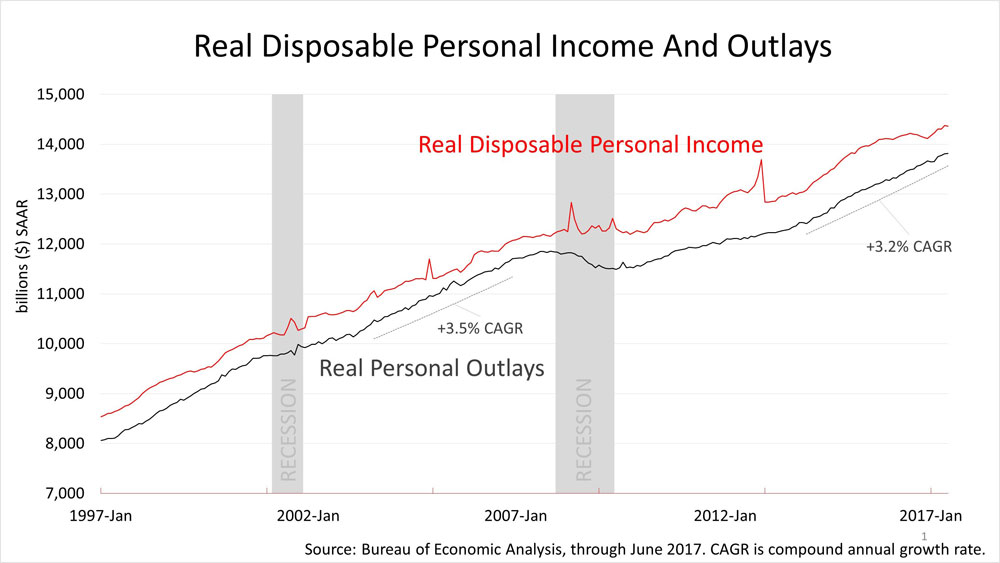

Perhaps the more important surprise in economic data this past week was today's report from the U.S. Census Bureau showing that retail sales, excluding gasoline, soared higher by +6.8% in the 12 months ended September 30, 2020.

Excluding gasoline because gas prices are so volatile, retail sales showed surprising strength considering that the Covid recession is barely over.

The Covid recession was the shortest downturn in modern history.

The surprising strength in retail sales is important because it shows consumers kept spending despite the pandemic, and consumer account for 70% of the economy.

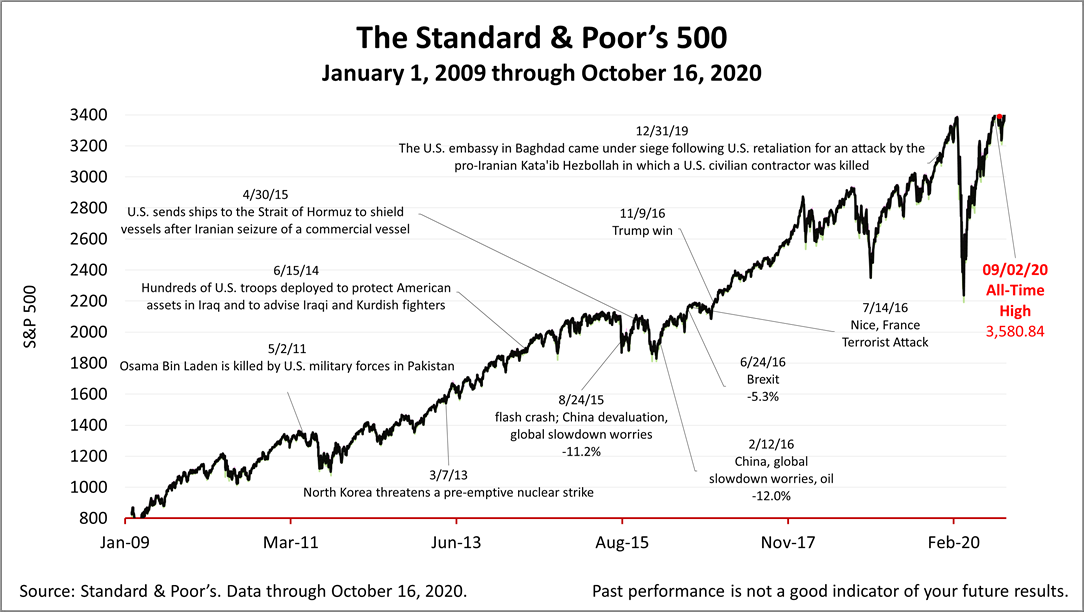

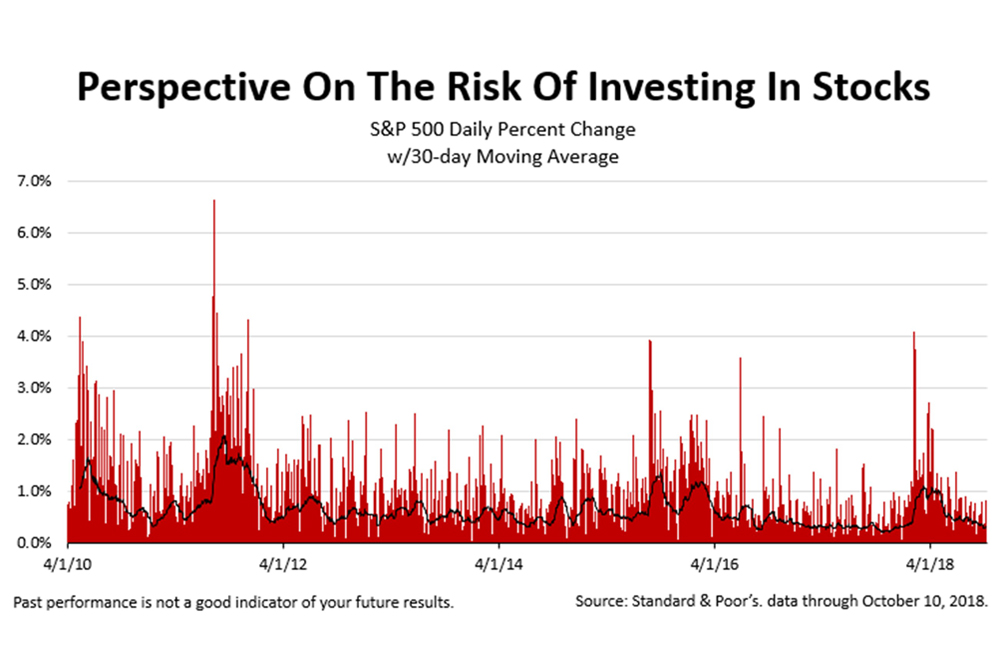

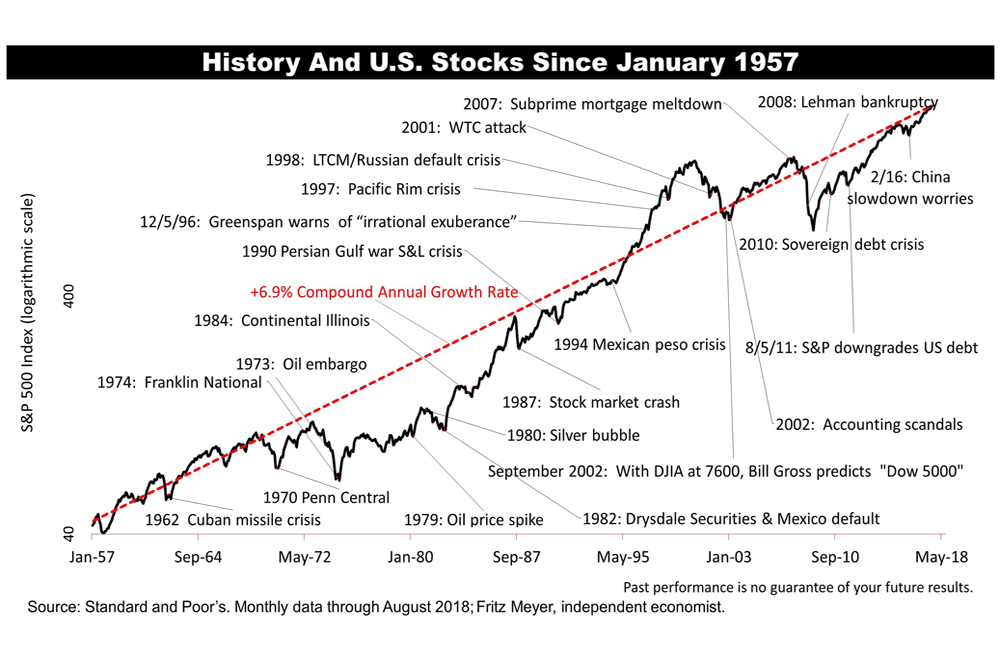

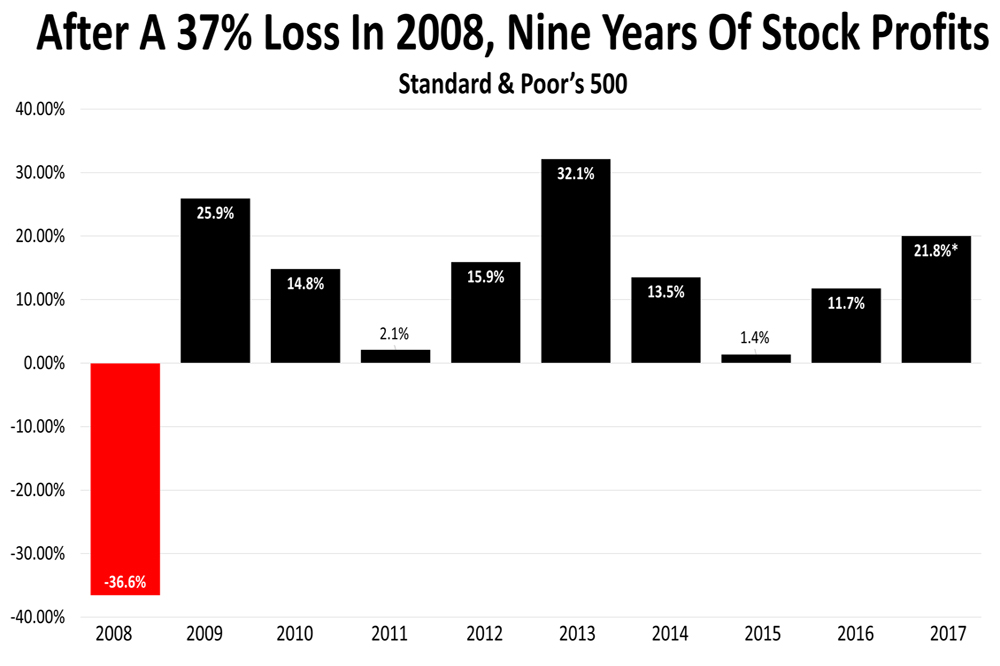

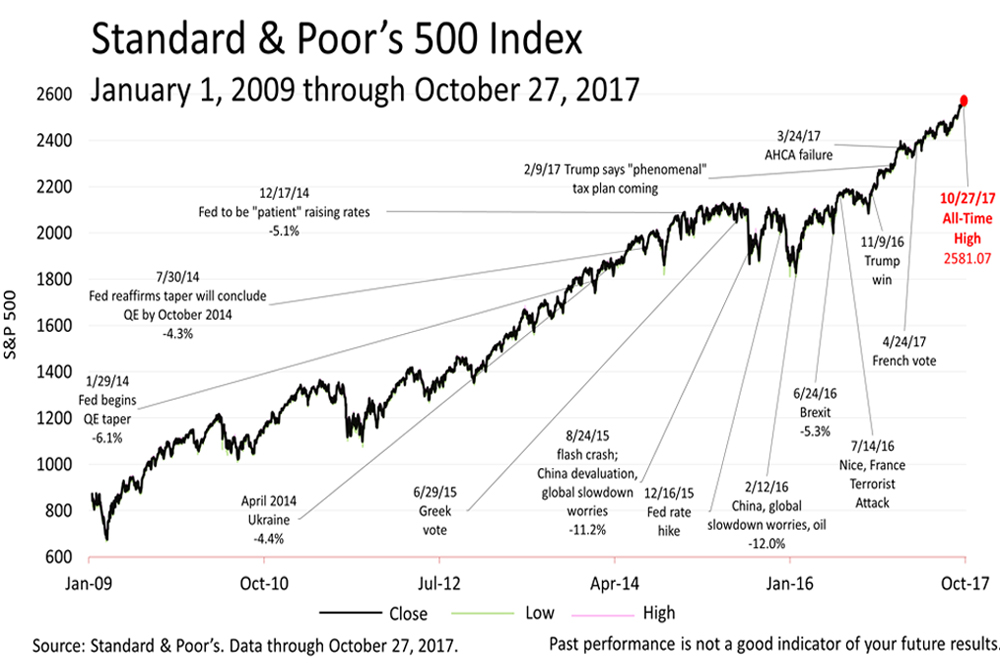

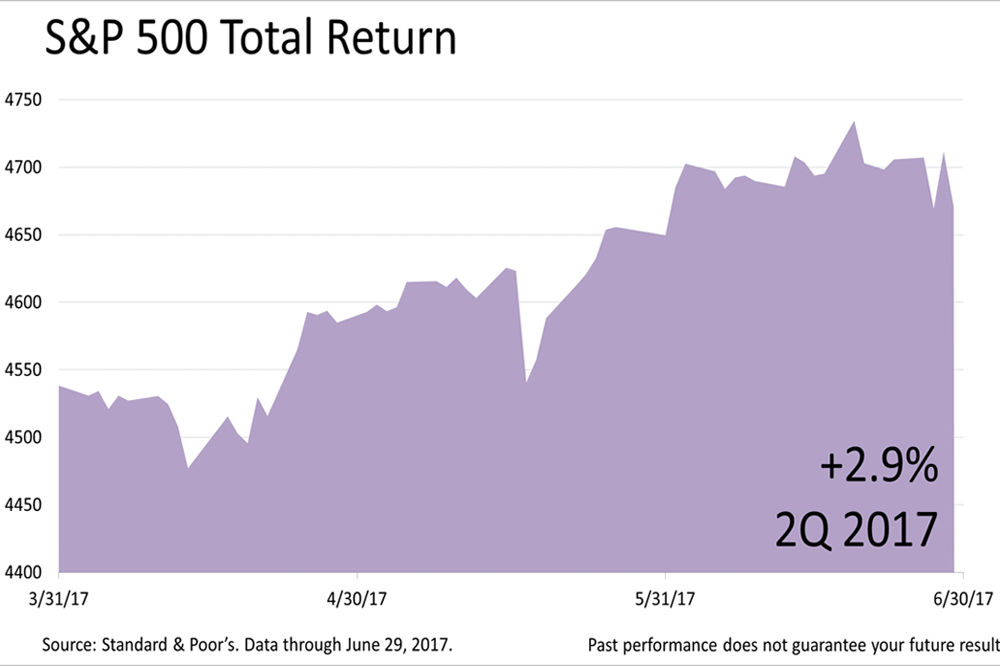

The Standard & Poor's 500 stock index closed Friday at 3,483.91, a fractional gain of +0.01% from Thursday and +0.19% from a week ago. While less volatile this past week, the S&P 500 closed Friday higher by +43.57% from its March 23rd Covid bear-market low.

Stock prices have swung wildly since the coronavirus crisis started in March and volatility is to be expected in the months ahead.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

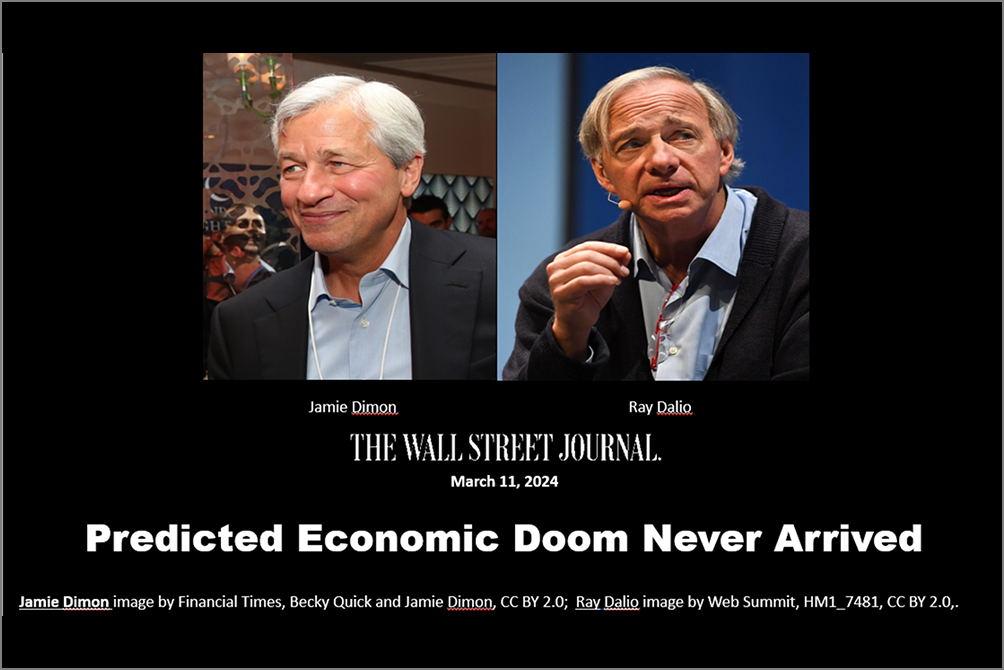

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding