Financial Planning

Financial Planning in a Nutshell

Financial planning is the process of determining how an individual's life goals can be met through the proper management of his/her financial resources. This process can include cash flow analysis, budgeting, insurance planning, investment management, income tax planning, retirement planning and estate planning.

Why Have a Financial Plan?

A financial plan is like a roadmap. You are at Point "A", but want to be at Point "B". How do you get there? A financial plan, or "roadmap", helps establish whether or not you can realistically accomplish your goals. Ongoing monitoring can help keep you on track, safeguard you against a catastrophic life changing event, and even protect you during economic crises - for example, the 2008 stock market.

The Benefits of a Financial Plan

Having a financial plan will help you define realistic goals over a personalized timeline. We are here to help you stay on track every step of the way - defining and re-defining your objectives and analyzing your needs at every life stage in order to provide you with financial security.

How Does It Work?

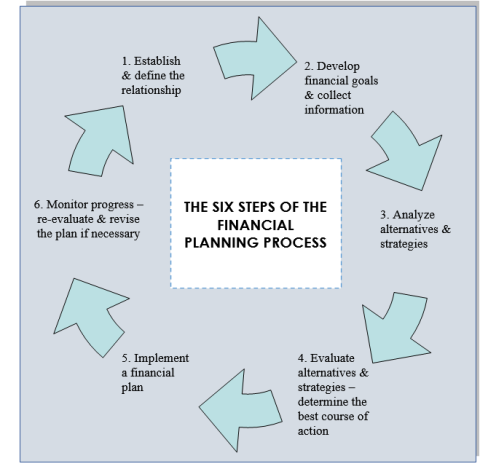

There are six steps to the financial planning process, titled as follows:

- Establish & define the relationship

- Develop financial goals & collect information

- Analyze alternatives & strategies

- Evaluate alternatives & strategies - determine the best course of action

- Implement a financial action plan

- Monitor progress - re-evaluate & revise the plan if necessary

We have established some additional details for people that are looking for specific life stage or life changing event planning. If you are an empty nester, a small business owner, have changed jobs (voluntarily or involuntarily), going through a divorce/separation, have received an inheritance or any other event that requires immediate planning, click on the links below for more information.

Life Stage Planning | Life Changing Event Planning